As prices on goods and services increase

it takes more and more dollars to afford

the same volume. Consumers can afford

a little inflation as long as their incomes

increase at a corresponding rate. Real

problems arise when household incomes

stay stagnant and prices keep rising. If

inflation is persistent then consumers

have to eventually make major

adjustments to their budgets. The result

of long-term inflation is economic

recession as things become unaffordable

to consumer and GDP growth will turn

negative at some point.

Oil and gas prices have a history of responding very quickly to rises in consumer spending. That’s because

economic growth can’t happen without fuel. Factories can’t increase the manufacture of more goods and

ship them around the world without an increase in the production of fuel. The cost of fuel has an impact on

everything we do. It’s even built into the cost of the food we eat. Oil and gas producers keep a close watch

on the changes in fuel inventories.

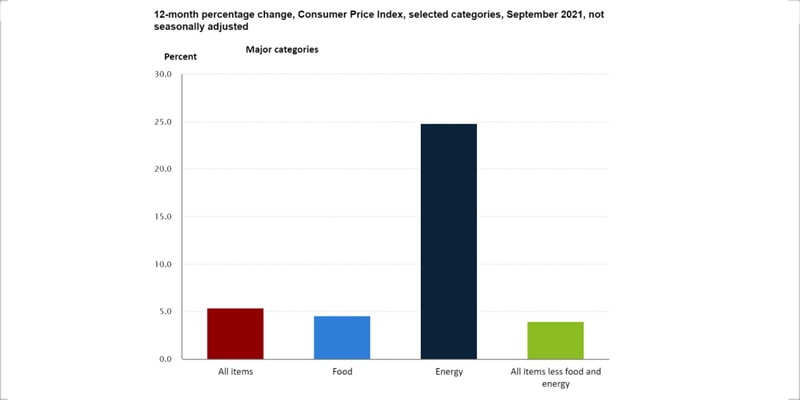

The Covid pandemic in early 2020 had a punishing effect on oil and gas producers as people all around the

world were ordered to stay home for a time. Travel basically came to a standstill and major roads and

highways suddenly become nearly empty. But as the economy has reopened the price of oil has

skyrocketed. Below is a graph from the Bureau of Labor Statistics showing the year over year increase in

energy prices (oil and gas) from September 2020 through September 2021.

What led to the big change? Travel still hasn’t recovered. Highways aren’t completely full like they were

before since many people still work from home.

To understand the forces pushing up prices in all areas of our economy we need to look back at the

recession of 2007-2008 known as The Great Recession. This was the time that our nation’s banking

system nearly imploded. What started out as a series of mortgage loan defaults by highly leveraged

borrowers quickly escalated into a real estate market crash after a recession pushed more and more

homeowners to abandon homes and default on their mortgages. A few large financial institutions failed

such as Washington Mutual, Lehman Brothers, and Bear Stearns. The huge recession led to a massive

deflation in the price of risky assets (stocks, real estate, etc.).

The Federal Reserve Bank intervened in the financial system to avoid a total collapse. To thwart a true

depression the Fed began injecting the U.S. economy with large amounts of capital under several stimulus

programs called “Quantatative Easing” (aka printing money). The size of these programs was enormous.

The first was QE1 in November 2008 to the tune of $600 Billion. When that failed to work the Fed

unleashed QE2 in November 2010 which was another $600 Billion. The markets reacted slowly and real

economic growth was far below estimates during this time.

To fuel a reinflation of the economy (and the stock market), the Federal Reserve launched QE3 in

September 2012. This program was a little different. The Federal Reserve Bank began purchasing $40

Billion of mortgage-backed securities (quasi-government bonds) to force interest rates lower and stimulate

consumer borrowing. This bond buying program didn’t end until October 2014 and by this time the Federal

Reserve had accumulated about $4.5 Trillion in government bond assets. By this time interest rates were

nearly down to zero and the stock market had started a long recovery. The Federal Reserve had discussed

reversing some of the stimulus programs in a gradual manner to avoid an overheated economy that would

result in inflation.

But then the Covid pandemic hit the world. As the U.S. economy experienced shutdowns and many jobs

were lost, the Federal Reserve quickly started QE4. They announced a $700 Billion stimulus program to

purchase more bonds. This time, though, they bought corporate bonds which sank in record fashion when

the stock market dropped 35% in a single month. This marked the first time the Federal Reserve had

directly purchased anything other Federal Government issued securities. It’s charter actually didn’t allow for

it was argued that drastic times called for drastic measured. By mid-summer of 2020 the Federal Reserve

had actually purchased an additional $2 Trillion of bonds from the bond market! These are absolutely

enormous amounts of capital poured into the U.S. economy through government intervention and the

printing of money.

You might be wondering what the point is for this stroll back in history? The purpose of all of these massive

stimulus programs was to reinflate the economy. Did it work? Yes. It took a long time but it definitely was

successful. But now we are beginning to see the consequences and you should be aware of what is likely

right ahead of us.

The impact from all of the stimulus

programs from 2008-2020 is going

to be long-term inflation unless the

Federal Reserve can begin to

undo the quantitative easing

programs from the past decade.

Inflation is now beginning to

greatly impact the real economy.

We are seeing it in rising food

prices, price of new and used

vehicles, basic materials used in

construction, etc. If you own a

home you’ve seen a huge increase

in the price of your home. If you

rent then you’ve noticed a huge

increase in your housing expense.

Just look at some of the annual rent hikes being experienced around the country. If this isn’t inflation then I don’t know what is

If all of this inflation isn’t enough, we are on the precipice of another gigantic stimulus program to fund clean

energy and massive social programs here in the United States. I’m not arguing for or against. I’ll remain

apolitical in this letter. Various fund managers and economists I follow estimate that some kind of stimulus

program will get passed before the end of the year. The size remains undetermined but could be between

$1.5 Trillion and $4 Trillion. Doesn’t sound like much on paper but remember these are massive numbers.

The Clean Electricity Payment Program component of the proposed stimulus program is estimated to cost

about $150 Billion. An independent study of the CEPP by an organization called Analysis Group estimates

that “implementation of a CEPP through 2031 would generate over $907 Billion in economic value added, and

create 7.7 million jobs”.

Ignoring the politics surrounding this stimulus program, what I foresee as a result is more money flowing

throughout the economy. That also means much more inflation over the next decade or two.

As I said earlier, a little inflation is not a bad thing. Runaway inflation is different. When prices spiral higher

more and more consumers become unable to afford the goods and services they want or need. The Federal

Reserve knows this and at some point they will be forced to do something to try to control inflation. Will they

act too late as they have historically done? I believe they will. They should be raising interest rates now and

reversing some of the bond buybacks implanted over the past decade. But they are hesitant to do it because

the Federal Reserve does not maintain political independence that it is supposed to have.

So far we’ve only discussed domestic sources of inflation. But keep in mind that the global economy is also

experiencing a real recovery as well. Ports all over the world are experiencing huge backups as the volume of

goods being purchased and produced and shipped to consumers has risen significantly over the past year.

We have heard much about the logjam at the Long Beach, CA port. But Rotterdam, The Netherlands (the

largest shipping port in Europe) is also backed up as volumes have surged 15% year over year.

All of this begs the question, what does this mean for me as an investor? First, the stock market thrives on

the prospects of higher future earnings generated by economic growth. And I think we are about to see a lot

more of that. So the answer is to hold on to your stocks. For now.

Certain areas of the market are going to benefit more than others. Inflation hurts the extremely competitive

industries like consumer staples: food retailers and utilities. Companies in these industries do have some

pricing power but are not always able to raise prices enough to cover the increasing costs of their inputs which are inventory and labor. Keep in mind that minimum wages are rising and companies are paying more to their

labor force to keep them around.

The areas of the market that are likely to thrive in this environment are financial institutions that make more

money when the markets are rising. Banks earn more when they can lend at higher rates of interest. When

the Federal Reserve tapers its bond buying programs and eventually hikes the federal funds rate then we will

see banks really prosper.

Suppliers of raw materials and construction supplies are also expected to do well since they have pricing

control and there is high demand for their products.

And the oil and gas industry is going to produce healthy earnings growth for the foreseeable future

regardless of how much clean energy we gain over the next decade. This industry is Morningstar’s #1 pick

right now.

Other notable fund managers at Fidelity, Vanguard, T. Rowe Price, Janus Henderson also expect healthy

growth for the coming year or two. But beyond that inflation could cause some real problems.